What did JP Morgan see on the road to finance?

J.P. Morgan has enjoyed collecting art throughout his life. To him, finance may be like a craft that he can fully master and control, and he is like a master craftsman.

Author: GUDORDI | 2023-04-11

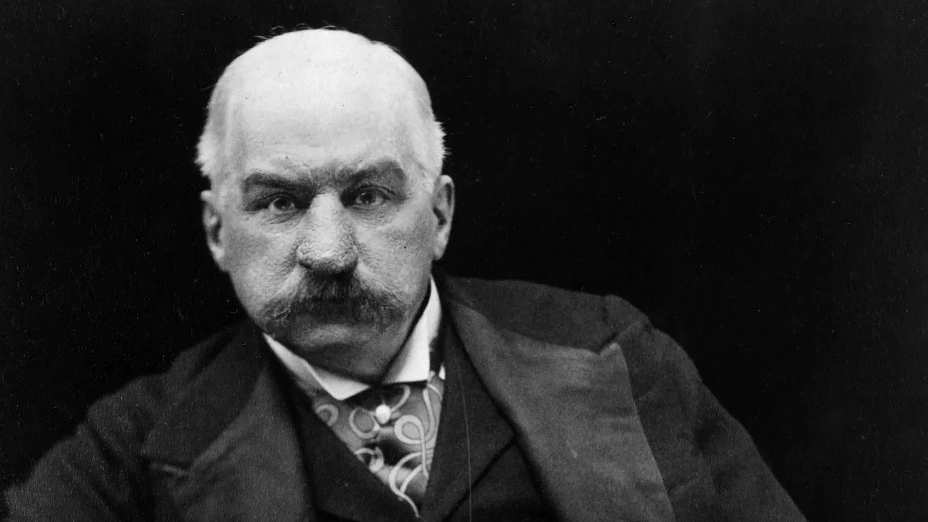

JP Morgan’s life story has been recorded in detail, from which we can get a glimpse of his thoughts. (Library of Congress photo)

Continuing from the above: “Legend in the financial world──Mr. J.P. Morgan”

Thoughts, reduced to paper, are generally nothing more than the footprints of a man walking in the sand. It is true that we see the path he has taken; but to know what he saw on the way, we must use our own eyes…)

──Schopenhauer

In the last chapter, the author mentioned that to understand the financial and corporate history of the United States, we must know JP Morgan. Many of JP Morgan’s deeds have been made into documentaries. One is titled “How One Man Financed America?”; the other is simply titled “That “The Man Who Owned America” (The Man Who Owned America) shows how powerful JPMorgan Chase was in the financial and corporate circles of the United States.

Combining finance and enterprise development to create an enterprise capable of monopolizing the market

Looking back suddenly, what JP Morgan did was not only to provide simple financial services, but to combine finance with corporate development to create huge wealth. Looking back today, JPMorgan Chase’s excellence is that as early as 1880, it had seen that the U.S. railroad industry was leaderless and there were many small and medium-sized railroad companies with insufficient financial strength and scale efficiency. This was a rare situation. Business and financial opportunities.

He should also note that Carnegie’s situation in the steel industry and Rockfitt’s situation in the oil industry show that the United States can provide space for some large companies to achieve a near-monopoly on the entire market, and through the advantage of scale, the company can almost dominate the industry. Unrivaled. From this perspective, what JP Morgan did can be understood as how to establish a monopoly in the emerging railroad industry in the United States like Carnegie did in the steel industry or Rockfitt in the oil industry.

If we look a little deeper, JP Morgan’s ambitions may not stop there. Judging from the life and deeds of JP Morgan, he may not be satisfied with the pure pursuit of increasing wealth. What he enjoys more may be relying on his understanding of the financial system, his own financial resources, and the financial market. Power can do something in the American financial world, the corporate world, or even the entire American economy.

Master financial craftsman

JP Morgan enjoyed collecting art throughout his life. To him, finance may be like a craft that he can fully master and control, and he is like a master craftsman. In his eyes, the entire financial and corporate world in the United States may be like a dynamic organism that he can thoroughly understand, fully master and control. He can make it possible for people who do not understand the financial market to his level. Something that felt incomprehensible and completely unbelievable.

It is worth noting that JP Morgan’s understanding of the financial market is by no means just talk on paper, but is supported by brilliant practical cases. In 1895 and 1907, the United States also faced financial crises. In 1895, the U.S. government faced bankruptcy because its gold reserves had been almost exhausted. Once this happens, the dollar and the entire U.S. economy may collapse. But in both cases, JP Morgan miraculously turned the situation around within a few days with the help of one person.

It can be said that JP Morgan single-handedly saved the U.S. government at least twice and resolved at least two financial crises in the United States. Therefore, it can be said that he saved the entire U.S. economy. In the history of global finance, this achievement is believed to be unbeatable so far. Therefore, some people lament that if JPMorgan Chase was still alive in 1929, the impact of the stock market crash on the U.S. economy would not necessarily be greater than that of the 1987 stock market crash. And if there had not been the Great Depression in the United States that began in 1929, perhaps the development of European and human history might have been different.

From what he did to what he saw

In any case, the author believes that JP Morgan’s thinking on the financial market is worthy of attention and reflection, and we can find a lot of inspiration from it on the development of Hong Kong as an international financial center. However, JP Morgan was not a scholar, and he did not leave any writings that would allow future generations to understand his master-level understanding of the financial industry.

However, fortunately, JP Morgan’s life story has been recorded in detail, and we can get a glimpse of his thoughts. The author believes that JP Morgan’s understanding of finance is related to his “finance is based on trust” mentioned above. The views are consistent. In the author’s opinion, JP Morgan’s words are similar to Johann Wolfgang von Goethe’s “Architecture is frozen music” and Einstein’s “Science is just elegant common sense.” “(Science is just refined common sense) These sentences are concise, to the point, and light, and can lead people to infinite space for thinking. They cannot be said without a master who has a thorough understanding of the relevant issues.

However, although these aphorisms are endlessly wonderful, it is not so simple to know how to penetrate their mystery and understand what enlightenment they can bring to Hong Kong. Perhaps, as the Schopenhauer quote quoted at the beginning of this article points out, to know what JP Morgan saw on his financial journey, we can only use our own eyes to see what he did on his financial journey. More on this next time.

“Hong Kong’s Legendary Future” Series 28

Contact the author: Gudordi@proton.me