Money Chapter 3: The Life of Economics Master Fraser

“Income is a series of events…” – This is what economics master Irving Fisher (1867−1947) wrote in his masterpiece “A Theory of Interest” The opening sentence of the second chapter. The master’s writing is indeed extraordinary. This thought-provoking sentence contains infinite wisdom. If you think about it carefully, you can almost see through the essence of his profound interest theory…

Author: GUDORDI | 2015-01-15

Money Chapter 3: The Life of Economics Master Fraser

Facebook

Twitter

LinkedIn

Pinterest

WhatsApp

Email

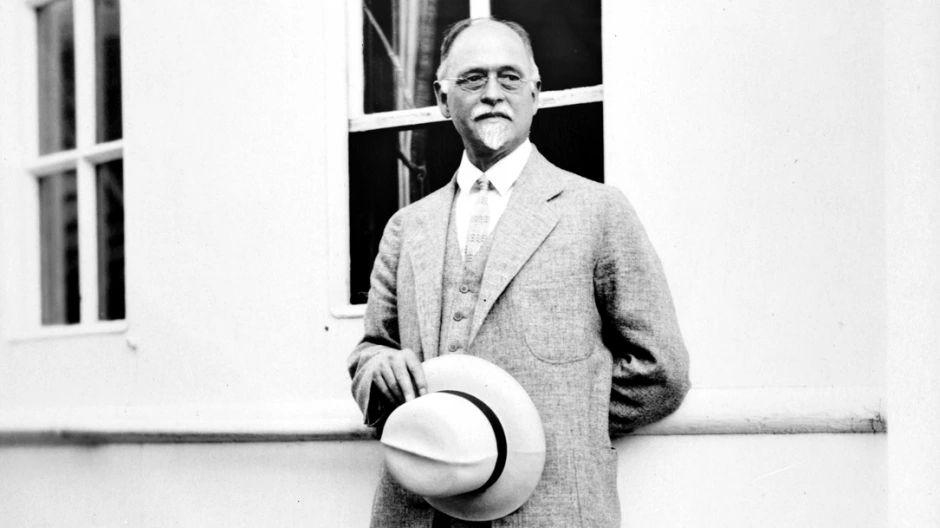

“Income is a series of events…” – This is what economics master Irving Fisher (1867−1947) wrote in his masterpiece ” A Theory of Interest ” The opening sentence of the second chapter.

The master’s writing is indeed extraordinary. This thought-provoking sentence contains infinite wisdom. If you think about it carefully, you can almost see through the essence of his profound interest theory…

The best economist in American history

Interest, Income, Wealth & Capital (Interest, Income, Wealth & Capital) are extremely basic and important concepts in the entire framework of economic theory. But perhaps the focus of classical economists has always been more focused on the operation of the market system, so they hardly seem to pay that much attention to these important concepts. “The Theory of Interest” published by Fraser in 1930 is believed to be the best book ever written to explain these concepts at that time – an achievement that may still have not been broken by anyone to this day.

James Tobin, the 1981 Nobel Prize winner in economics, once praised Fraser as the best economist in the history of the United States and said that this is the consensus of many economists. I believe that Fraser is well-deserved for this praise. Paul A. Samuelson, who won the Economics Prize in 1970, and many other famous economists have given similar praise to Fraser. It is worth noting that although Fisher’s contributions to the economics field spanned many fields, from a purely theoretical perspective, “Interest Theory” should be the representative one. What’s more interesting is that the author believes that Feisha’s views on concepts such as wealth, income, interest, and capital are likely to be inextricably related to his legendary and dramatic life. As a master with a deep understanding of wealth in scientific concepts, how Fei chose to spend his life can bring enlightenment to our understanding of wealth. Therefore, the author will take the trouble to give some introduction to Fei’s life this time.

"I'd rather work myself to death than lie here and wither away."

Fraser’s academic talent and talent attracted the attention of many people early on. As early as his 20s, many people believed that he would be one of the most outstanding scholars in the history of Yale. In Fraser’s day, economics had not yet become an independent discipline, and Fraser majored in science and philosophy when he attended Yale University. Like many great thinkers, Fraser had a wide range of interests. In addition to science and philosophy, Fraser’s interests also included poetry, astronomy, geometry, etc. However, Fraser’s greatest interest is believed to lie in mathematics and economics. Although Yale did not have an economics department at the time, Fraser studied economics enthusiastically and eventually became the first person to receive a doctorate in economics from Yale University. Fraser remained at Yale University throughout his life. Work.

However, just when Fraser was in full swing academically, he was unfortunately diagnosed with tuberculosis. At that time, tuberculosis was considered a terminal disease, and many doctors also believed that Fraser’s time was short, so Fraser could only lie in a sanatorium on the Arizona Mountains all day long, silently waiting for the final days to come – he was only 29 years old at the time. . Days like this passed day by day, until one day, Feisha suddenly said to himself with enlightenment: “I’d rather work to death than lie here and slowly wither.” (I’d rather work to death.) than rust to death idly), he immediately left the hospital bed and began his non-stop work and fight against the disease.

Perhaps because Phezzan never knew if tomorrow would happen, he threw himself into researching everything that interested him. Fraser’s interests are indeed very broad. In addition to economics, statistics, index theory, etc., there are also public health, medical care, and world peace… According to records, Fraser classified his works and interests into categories in his later years. , there are as many as 2000 categories!

Multimillionaire becomes "negative equity"

I don’t know whether it was God who was moved by his desperate devotion to research, or whether his self-created treatment method worked wonders. Miracles followed: Fraser successfully lived day after day, and his tuberculosis was cured. . Moreover, Feisha’s work and inventions brought him huge income. In addition to being a thinker and philosopher, he was also an inventor. Many of his inventions – especially the autocratic power of index setting (which is also the origin of various financial and economic indexes that are widely used today) – provided He brought great wealth. On the other hand, he also actively invested his wealth in the stock market, so his wealth once exceeded US$10 million, which was almost an astronomical figure at the time.

However, unlike many other economists, Fraser really puts his ideas into practice. He was optimistic about the stock market, so he invested all his wealth in the stock market. Shortly before the Wall Street crash in 1929, he expressed his opinion that “the stock price has reached a seemingly sustainable plateau” (stock prices have reached what looks like a permanently high pleateau). It is worth noting that after this sentence, Fraser wrote, “I do not agree with the views of the bearish people. I think the stock price is about to drop by 50 or 60 points. Even if this happens, I don’t think it will happen in the short term.” “(I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as [bears] have predicted.)

He also proposed a theory of “debt inflation” at the end of the period, pointing out that the tightening of monetary policy followed by the U.S. Federal Reserve at that time was the basic reason for the multi-year Great Depression in the U.S. economy. If the Federal Reserve had not done so, The impact of the stock market crash was not so great (later Milton Friedman, the 1977 Nobel Prize winner in economics, collected a large amount of data to study related issues, and his conclusions also supported Fraser’s point of view). However, the fact is that most of the media and the public tend to focus on one point, and the above sentence by Fraser has become a classic sentence to describe people’s blind optimism about the stock market. Perhaps because Fisher’s sentence was so deeply rooted in the hearts of the people at the time, Fisher’s reputation was deeply affected in the contemporary era. However, Fisher’s significant contribution to economics seemed to have been ignored at the time, and it was not until many years later that the situation emerged. Change is regrettable.

Never tire, the happiest person

In any case, the Wall Street crash of 1929, and the subsequent bear market that lasted for many years, caused Fraser not only to lose all his money, but also left him heavily in debt, although his main creditor was his wife’s sister. Later, after Yale University learned of his financial situation, he was given free dormitory accommodation so that he could continue his research work. It is worth noting that despite such drastic changes, Fraser remained an optimistic person throughout his life and consistently focused on what he believed was worth doing – including advocating the establishment of a medical insurance system and lobbying insurance companies to provide customers with affordable insurance. provide appropriate physical examination services and improve society’s awareness of public health. He is best known to the American public for his 1915 publication of a book about his battle with tuberculosis called How to Live: Rules for a Healthy Life Based on Modern Science. Healthful Living Based on Modern Science ).

In this book published nearly 100 years ago, Fraser already proposed the concept of “biological living”. The master’s perspective is really amazing! The book became so popular that it has been reprinted at least 90 times and has sold at least millions of copies! According to records, on Fraser’s 80th birthday in 1947, scholar Cohrssen described Fraser this way: “He is still never tired of talking, and he is the happiest person I have ever met.” (He is still) tirelessly active and one of the happiest men I’ve ever met.)

The “columns and arches” of economics

There is no doubt that Fraser has a lofty status in the economics community, but many scholars also believe that if Fraser had not spent so much energy on social and public health issues, his contribution to economics may be far more than this. . Although economics master Joseph Schumpeter once praised Fisher for establishing “pillars and arches” for the theoretical framework of economics, as another economist lamented, if If Fraser could allocate more time to economics, he might have completed “a kind of temple of economics” for economics!

Undoubtedly, Fraser’s investment in social and public health issues may be a big loss to economics, but for Fraser, this may not necessarily be the case. In the next episode, I plan to talk more deeply about Fisher’s “Interest Theory” and how this generation of economics masters scientifically understand and explain the concepts of money and wealth.